This week’s story: Shaping the future world map of crypto hubs

Crypto is a not a niche topic anymore.

As crypto adoption progresses and big money pours into crypto ventures, crypto is becoming more of a political topic, and one that divides.

Crypto opponents resort to the standard crypto FUDs like “criminal activity” or “environmental harm”, while pro-crypto politicians are speaking about innovation and the new industry that is being born.

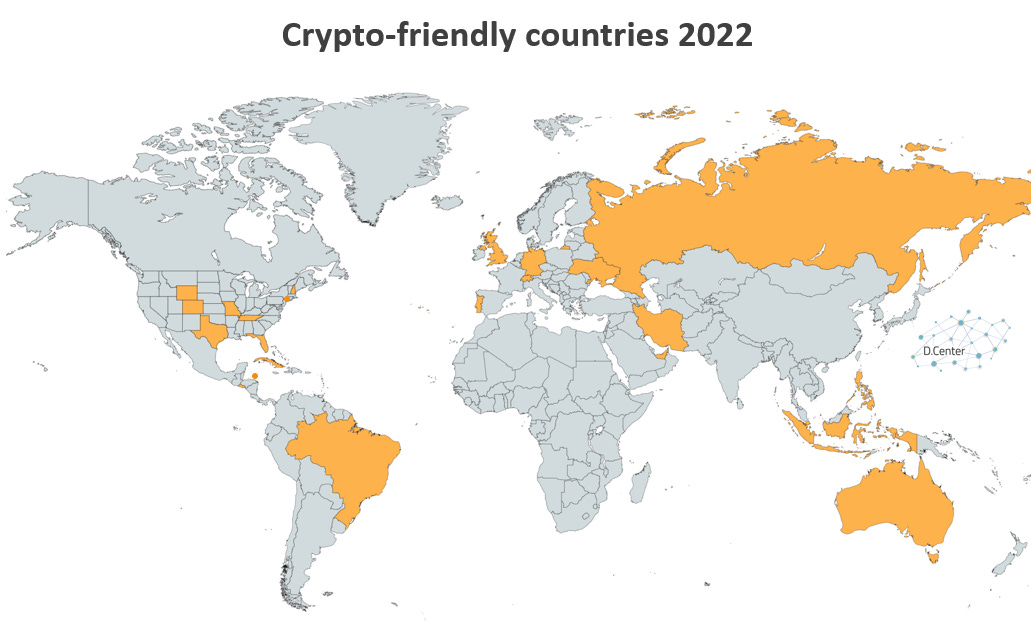

Unfortunately, anti-crypto politicians are still more numerous, and this is all but understandable: the industries and institutions that crypto has come to disrupt have powerful lobbies. However, pro-crypto voices are starting to rise, and some jurisdictions, and even countries, are ready to seize the opportunity to become the tech hubs of the future.

The tools at the disposal of both sides are more or less the same and most often include AML regulations, taxes, registration requirements, as well as crypto inclusion in a wider legal framework.

Those who don’t want crypto

The world’s biggest anti-crypto country is China, which set an outright ban on crypto mining and use last year. China is an authoritarian country that likes to control the smallest details of its citizens’ lives, so independent crypto was clearly not the right fit… digital yuan will do the Big Brother job much better.

Nigeria too has high hopes for its CBDC, the e-naira, but it did not go as far as banning crypto, it only banned financial institutions from facilitating crypto operations and transacting with entities engaging in crypto. So far the e-naira managed to attract less than a million users, while crypto, even stifled, is being used by tens of millions of Nigerians (the recent Gemini report suggests up to 50M). What’s regrettable is that despite this grassroot adoption the official crypto industry cannot develop in Nigeria, and its citizens have to use the services built in other countries.

Another region that becomes increasingly anti-crypto is not autocratic, but a heavily bureaucratic one. It’s the European Union.

The European Parliament doesn’t really have a say on its member states’ taxes, but it can guide an environmental and AML policy in the EU, and it has recently used both to hinder crypto.

Last month the EU Parliament quite narrowly voted against banning PoW-based cryptocurrencies for environmental pretext, but the joy didn’t last long. It was followed by a vote in favour of impossibly strict AML requirements that would oblige crypto service providers to gather details on all crypto transfers starting from €0 and including non-custodial wallets.

This last vote was decisive for many European crypto companies, who have less and less hope that the Union will allow them to develop their businesses. Some have already announced moving to the neighbouring Switzerland or other crypto-friendly places, in what appears to be a start of a massive exodus of the industry.

Other countries that have banned or heavily restricted the use of crypto include Bolivia, Turkey, Egypt, Morocco, Algeria, Iraq, Bangladesh and Nepal.

Those who want crypto

The Americas

A country which has probably the most to lose from the rising popularity of cryptocurrencies is USA, as the dollar’s role as reserve currency and universal means of exchange is challenged by crypto. At the same time, US is home to some of the world’s biggest crypto companies, and big tech community in general.

This ambiguous situation has been translating into Federal Government vs States/Cities competition for a long time, but the general attitude has recently shifted a bit in the crypto direction. President Biden’s executive order tasking key offices to study crypto risks and “promote the US leadership in crypto tech” has shown an intention, and the ensuing report from the US Treasury – crypto’s sworn enemy – has even conceded that “the use of crypto assets for money laundering continues to be significantly less prevalent than the use of fiat cash and other more traditional means.”

The Fed and the SEC are still rather hostile, but they are being increasingly challenged by pro-business and pro-innovation jurisdictions:

Miami and the rest of Florida, New York City, Texas, Wyoming and Colorado, with Missouri and New Hampshire aspiring.

American entrepreneurial spirit and the particularities of its legal system allow innovation to thrive on the state level, which makes the US as a country rather crypto friendly.

Latin America is a region with one of the highest grassroot crypto adoption rates in the world, which is totally understandable, taking into account weak currencies, sky-rocketing inflation and currency controls effective in many countries. While the IMF succeeded in blackmailing Argentina to move away from crypto, Brasil is increasingly likely to become a LatAm crypto hub.

Brasilian Senate has recently approved a bill creating a clear legal framework for crypto, and the Mayor of Rio de Janeiro is aspiring to turn his city into a crypto hub Miami-style, allowing to pay property taxes with crypto (with a discount), allocating a part of the city budget to crypto and attracting crypto businesses.

At a smaller scale the country of El Salvador is still the world’s leader in crypto-friendliness, with Bitcoin as a legal tender and plans to build a “Bitcoin City” innovation hub. This week the neighbouring Honduras also announced a crypto initiative within its special economic developement hub Prospera, where crypto will de facto operate as a legal tender.

Europe

On the European continent the most crypto-friendly country is no doubt Switzerland, home to the famous Crypto Valley in the canton of Zug. Local government put a lot of effort into attracting crypto businesses, starting with Ethereum Foundation back in 2014, and is now one of the biggest clusters of crypto companies. Other cantons, like Geneva, Neuchâtel and Lugano, are emerging as alternatives.

The UK, which used to be rather crypto hostile, has recently had a change of heart. Last week – just days after the EU Parliament casted its disastrous AML vote – the UK Government published a “plan to make UK a global cryptoasset technology hub”, which includes the possibility to make stablecoins a recognised form of payment, introducing a financial market infrastructure sandbox and making crypto tax system more competitive. From where we stand, this looks like a clever move to seize the opportunity graciously presented by the EU.

Within the EU, some member countries do acknowledge crypto potential, like Germany (banks can offer crypto services, spezialfonds can allocate up to 20% to crypto and 0% tax on crypto gains) and Portugal (no crypto capital gains tax and 5% company tax in the autonomous region of Madeira).

In the Eastern Europe Ukraine has a big potential for crypto business, and it has recently set a clear legal framework allowing it to develop. The war, of course, has halted everything, but crypto has been playing an important role for gathering donations from all around the world to support Ukraine, which increased its crypto-friendliness even more. When the war ends, Ukraine could become an interesting place to set up a crypto business.

Middle East

In the Middle East it is Dubai that has been positioning itself as an innovation hub, and unsurprisingly it took a crypto-friendly attitude, attracting many crypto firms. Crypto is regulated by the specially created Dubai Virtual Assets Regulatory Authority, tasked with licensing, regulation and governance of crypto businesses.

Asia and Oceania

In Asia Singapore was one of the first to introduce legal framework for crypto and start attracting crypto fintech companies. However, some think that the Singaporean regulation is too strict, which discourages new companies from coming.

Philippines is a country famous for having the biggest Axie Infinity players community. Many Filipinos are also reliant on remittances from their relatives working abroad, so crypto adoption is high, and the government is crypto-friendly.

Indonesia is a somewhat ambiguous country, having banned crypto as means of payment, but treating it rather nicely as a commodity: the country has recently set a 0.1% tax on both capital gains from crypto and its VAT. Comparing to the standard 30% tax on capital gains in many countries, including the neighbouring India, 0.1% looks like an incentive.

Australia has been warming up to crypto recently too. Last week, its Securities Regulatory Authority given the green light to crypto ETFs, and the Commonwealth Bank announced it would allow its users to trade crypto.

A small Polynesian nation of Tonga has also decided to bet on crypto and announced its plans to adopt Bitcoin as legal tender in 2023. Like El Salvador, it also has its share of volcanoes, and it is also planning to set up crypto mining operations on them. Crypto nomads becoming ever more numerous, paradise-looking Tongan islands could indeed get themselves a pretty nice industry.

Crypto regulations around the world change fast, oscillating between the old world’s status quo and the appeal of innovation. However, the industry does not wait for a particular country to decide on crypto and goes wherever it is most welcome. The Internet development happened mostly in the United States, and we now see just how important it turned out to be. Will the crypto industry repeat the same pattern, or other countries will be able to seize their chance?