This week’s story: Why Bitcoin is still the gold standard of cryptocurrency

This week the 19’000’000th bitcoin was mined.

This means that there are only 2’000’000 left to mine by 2140.

Bitcoin is scarcer than gold and basically any other valuable fungible asset, and there will only be 21 million of it. This is all public knowledge, but it still looks like most people do not fully realize how important Bitcoin’s scarcity is and how its actual price of $46k is far from representing its real value.

Bitcoin is not only the first blockchain ever created, it is the standard of cryptocurrency – an independent borderless money available to everyone everywhere.

This week we’ve been thinking about Bitcoin importance and its outlook for the future.

“Better Bitcoins”

Unlike most recent blockchains, Bitcoin was created to serve purely as money, and the simplicity of its code contributes to its robustness.

Yet numerous projects tried to create a ”better Bitcoin”, modifying parts of the protocol, namely the blocktime (10 min) and blocksize (initially 1MB):

- In 2011 Litecoin proposed x4 faster blocktime

- In 2013 Dogecoin was created as a joke making fun of Bitcoin speculation, with a x10 faster blocktime

- In 2017 Bitcoin Cash proposed to increase blocksize x32

- In 2018 Bitcoin SV proposed an improbable increase of blocksize x2000

These projects aimed at increasing the scalability, i.e. transaction throughput, which would allow for faster and cheaper transactions.

However, a shorter blocktime means a bigger coin supply and a risk of centralization: as it takes around 12 seconds for the new blocks to propagate within the network, the node that mined the previous block has more chances of finding the PoW for the following.

A bigger blocksize too will take more time to propagate within the network, causing asynchronous situations, but it would also mean a heavier blockchain, which would make it more difficult for an average node to download it and ultimately lead to centralization.

Curiously enough, the coin that fared the best among “Bitcoin alternatives” was Dogecoin, thanks to its community and Elon Musk’s endorsements.

13 years after its creation it became obvious that in the “pure money” category Bitcoin parameters are perfectly balanced, and with the rise of layer-2 solutions like Lightning Network, which can greatly increase transaction throughput, there’s no need to try and reinvent the bicycle.

Smart contract platforms’ money

Now, is it possible that the currency of smart contract platforms like Ethereum would take over the “just money” function of Bitcoin ?

These blockchains were created with numerous functions in mind, and they are meant to serve as foundations for all kinds of DApps that will compose the Web3. Ethereum, Solana, BSC, Avalanche, Terra, Cardano, Polkadot, Near… all these blockchains have their native currency that fuels their activity, and which could be used as money even outside their direct ecosystems.

This week Ethereum’s creator Vitalik Buterin published a post reflecting on “Bitcoin maximalism”. Despite the date of publication – April 1st – it actually gives a pretty clear view on Bitcoin vs blockchains with a “rich statefulness” allowing all sorts of applications. According to Vitalik, “Bitcoin developers are worried about the risks of the systemic complexity that rich statefulness being possible would introduce into the ecosystem”. So focusing exclusively on being money makes for better money, and high-performance layer-1 platforms will always carry a risk of their complexity biting them back somehow.

Smart contract platforms are also heavily reliable on the PoS consensus (only Ethereum is still PoW, but actively moving to the PoS update). While PoS is a simpler solution and it avoids the energy consumption polemics, it has a number of setbacks: easier DDoS attacks (of which Solana suffers regularly), centralization risk (of which BSC is often accused)…

We believe that when it comes to money, it only makes sense that producing it and moving it requires a very real price to pay, which in case of PoW is electricity and hardware. Moreover, it is totally possible to pay this price without compromising the ecology.

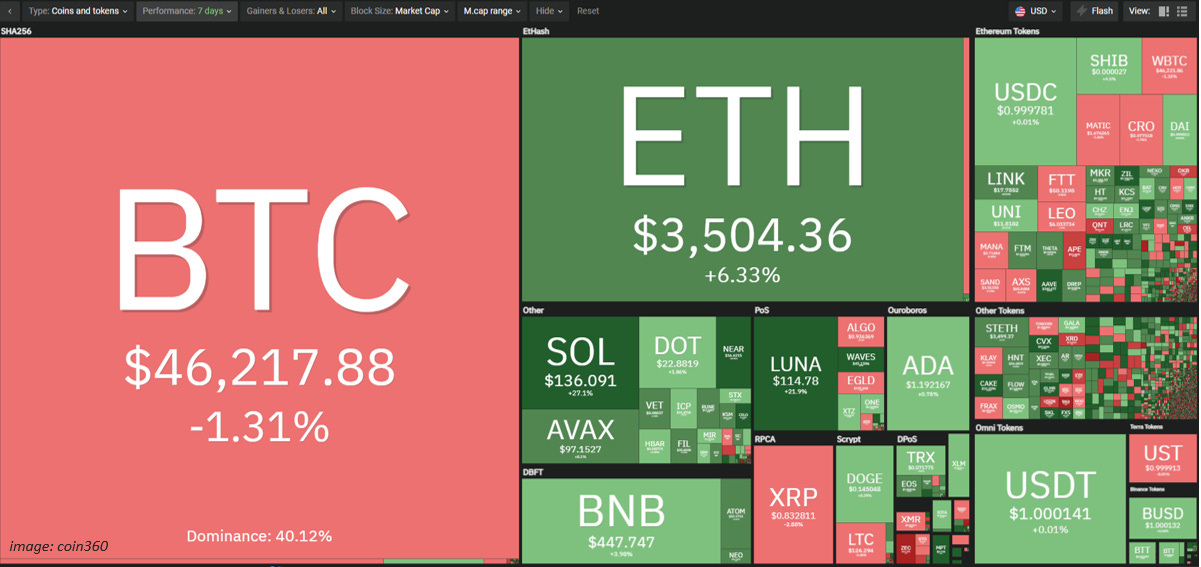

Can it be that a better consensus comes along to challenge the PoW’s security? It is possible. But for the moment it still has not happened, and Bitcoin PoW consensus is the world’s most robust and Bitcoin still maintains a 40% dominance within the crypto market.

The Lindy effect

Bitcoin is a good example of the Lindy effect – a theorized phenomenon by which the future life expectancy of non-perishable things like technology or idea is proportional to their current age. In other words, the longer a technology survives, the bigger are its chances to continue surviving in the future.

Bitcoin technology is exceptional from the longevity point of view: being an open-source software available to anyone anywhere in the world for the last 13 years, Bitcoin has never been hacked or exploited (a bug was found and corrected once in 2010). Moreover, it has successfully undergone important upgrades that every software requires, and it did that in a totally decentralized way.

Throughout the years, Bitcoin has maintained its decentralization, and the 2017 Segwit update has shown that not even the miners – indispensable workers maintaining the blockchain – can impose their vision to the detriment of other members of Bitcoin community, such as users.

The Bitcoin standard

The foundation of any money is trust, whether it is in gold’s scarcity, or your government’s ability to pay its debts.

More than any other cryptocurrency, Bitcoin has gained the trust of millions of people, and this trust has transformed into a growing adoption.

Amidst the current geopolitical tensions, inflation, dollar losing its grip on the world economy and the ever-growing feeling that the world is changing, more and more people look at Bitcoin as a future global reserve asset. Some, like the global investment firm VanEck, even go as far as estimate a BTC price between $1.3M and $4.8M in case it replaces the M0 and M2.

It’s a bold assumption, but we do live in a transition period, and it is up to us to create the future economy. We at D.Center would really prefer it to be based on an independent borderless money rather than centralized and privacy-violating digital yuan, digital dollar or digital euro.