This week’s story: The State of crypto FUDs

FUD acronym stands for Fear, Uncertainty and Doubt, and is used to describe the strategy influencing public opinion by disseminating negative, dubious or false information.

Like so many new technologies before, crypto is disrupting the status quo so far comfortably exploited by many institutions: monetary, banking, finance, gaming, commerce etc. Some of them, like gaming, art, online commerce, media, and even finance to some extent, have already started to embrace crypto, as it allows them to diversify/optimize their operations without threatening the core business model. Even some banks realized that crypto could be their ticket to the future and started proposing crypto-related services (most actively in the US, Singapore, Germany, Switzerland and Liechtenstein).

However, to the banks who firmly stand on their anti-crypto position and the actual monetary institutions in power, crypto can be a threat, simply because it gives a better alternative to the fiat money.

Of course, fiat will stay relevant as long as the government uses it for collecting taxes or social policy. But crypto is a threat nonetheless, and many national and international monetary institutions have embarked on an information war against it, spreading FUDs.

The majority of them can be put into two categories – the “criminal activity” FUD and the “environment” FUD.

“Criminal” FUD

Not a week passes without some official somewhere speaking about crypto use in criminal activity. Remarkably, without giving concrete numbers or stats… most probably because the stats do not support the thesis.

Blockchain is immutable and transparent, so literally everyone can check all of the transactions that have ever happened on it. With some IT resources and skills, it is even possible to tie pseudonymous addresses to a real-life person or organisation. On-chain analytics firms like Chainalysis or Scorechain and law enforcement all over the world are now getting pretty good at finding criminals who dare to use the blockchain, as shows the recent bust of crypto hacked from Bitfinex.

This is the reason crypto is now very rarely used by criminals: Chainalysis estimates that only 0.15% of the total cryptocurrency transaction volume was generated by illicit activity, and most part of it concerned crypto scams, which by definition cannot use anything but crypto (learn more about crypto crime here). In 2021 this percentage translates to around $14 Bn.

In the meantime, the UN estimates that $1,6 TR is laundered each year in cash.

The International Consortium of Investigative Journalists, a group responsible for the Panama Papers, Pandora Papers and other similar money laundering investigations, estimates that the money held offshore ranges from $5,6 TR to $32 TR.

Crimes involving crypto would make 0,8% – 0,04% from these amounts, but still the officials prefer to blame it all on crypto ?

Institutions exploiting the “criminal” FUD

This week the director of the French AML body Tracfin spoke to the European Parliament, telling the lawmakers that crypto is being used to “fund terrorism in Syria and Iraq and child pornography in Southeast Asia”. He used that to plead for the “deanonymization from the first euro” of crypto payments, which would amount to extend the already controversial FATF “travel rule” for any crypto payment, and not just for those starting above the $1000 threshold. On practice that would mean that crypto service providers would have to provide financial authorities with the detailed information on the sender and the receiver of any crypto transaction, even for the amount of €1.

Bureaucrats love bureaucracy, and the colossal amount of additional work such a rule would create could rejoice some… but also push the existent crypto service providers away from the European market, as the increased red tape burden will impede their operations.

In this scenario the Tracfin will happily hunt every euro spent in Bitcoin, all while money laundered in fiat through traditional banks and regulated financial institutions will still be measured in hundreds of billions of dollars (Danske Bank laundered €200Bn; CumEx files participants like Deutsche, Santander, BNP and others scammed the European tax system for €140Bn, UBS accused of casually helping their clients with tax evasion: only the American clients may account for $100Bn annually… etc).

The IMF, despite its official “reducing global poverty, encouraging international trade, and promoting financial stability and economic growth” motto, is regularly trying to strong-arm the countries into renouncing crypto. It has failed spectacularly with El Salvador, where President Bukele keeps hoarding Bitcoin, but it has recently succeeded in Argentina. In order to restructure its $45Bn debt, the IMF imposed a condition, obliging the government to “discourage the use of cryptocurrencies in prevention of money laundering and informality”, to which Argentina complied.

Another fierce anti-crypto opponent is Christine Lagarde, head of the European Central Bank. So far she has jumped on literally every occasion to try and smear crypto, and she is now actively using the war in Ukraine as an opportunity to push her anti-crypto agenda. Despite numerous specialists assuring that the sanctions imposed on Russia will comprise crypto as much as fiat (and there are ways to enforce it), Mme Lagarde is telling anyone willing to listen that Russia will use crypto to evade the sanctions. This week she repeated it at the BIS Summit, concluding by: “So is it a threat? Yes. Has it … been a threat in the past? Yes, because when you look at a lot of the dubious transactions that are taking place, a lot of the criminal activities payments that are taking place, very often you find some crypto assets.” The vagueness of the argument perfectly matching the vagueness of the accusation.

US Treasury changing tone

On the other side of the pond the mood used to be somewhat similar, with crypto’s sworn enemy Janet Yellen, the Secretary of the US Treasury, declaring crypto “inefficient” and “dangerous” on many occasions. Mrs Yellen is the fourth-ranking member of the executive branch, and she has contributed to many regulatory pitfalls that could harm the crypto industry. However, recently her agency’s mood started to change.

A recent US Treasury report noted that crypto use for money laundering “remains far below that of fiat currency and more traditional methods” (“The 2022 National Money Laundering Risk Assessment”), and this week Mrs Yellen herself decided to soften the tone, saying : “There have been benefits from crypto and we recognize that innovation in the payment system can be a healthy thing”.

It looks like the tide is turning in the US, and given the country’s leading role in the world’s finance, maybe it would signal the end of the “criminal” crypto FUD.

“Environmental” FUD

Two of the world’s biggest blockchains by market cap – Bitcoin and Ethereum – use the Proof-of-Work consensus to keep the network nodes agreed on every new block added. The process of getting that PoW is called mining, because the first one to succeed gets rewarded in newly created bitcoins. It however requires significant amount of electricity, which makes it a perfect target for another type of FUD, the “environmental” one.

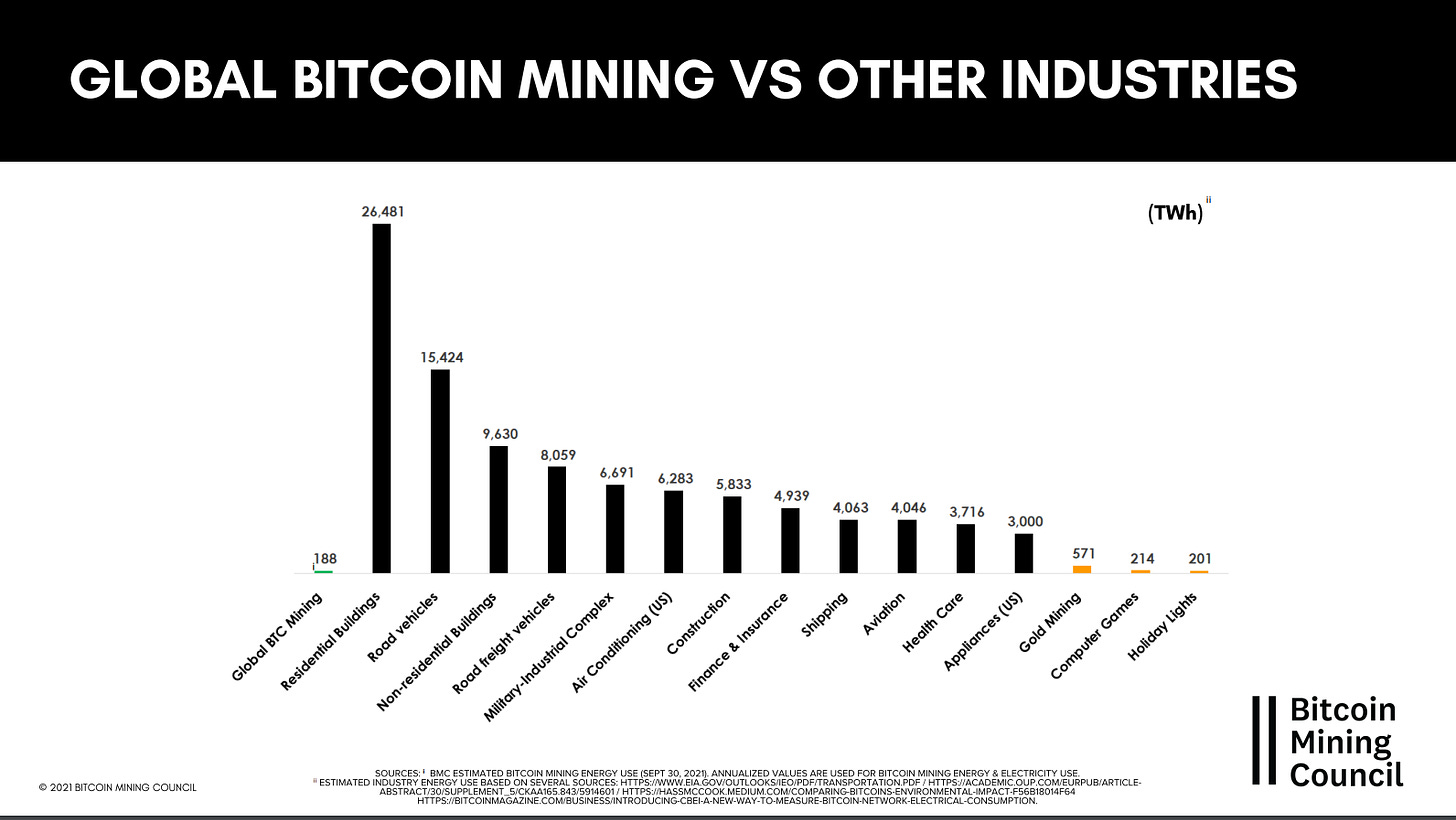

Here again, despite crypto mining being one of the greenest industries on Earth (58% of energy used comes from renewables), and its potential to become 100% green, it is regularly pointed out as “dirty” and even accused of contributing to the climate change. Curiously enough, no other industry gets slammed like this, even if the estimations of their energy consumption are much higher, much less green, and much more polluting (just take gold mining industry that uses x3 more electricity than Bitcoin from non-renewable sources, but also pollutes soils and waters with toxic chemicals and causes massive deforestations).

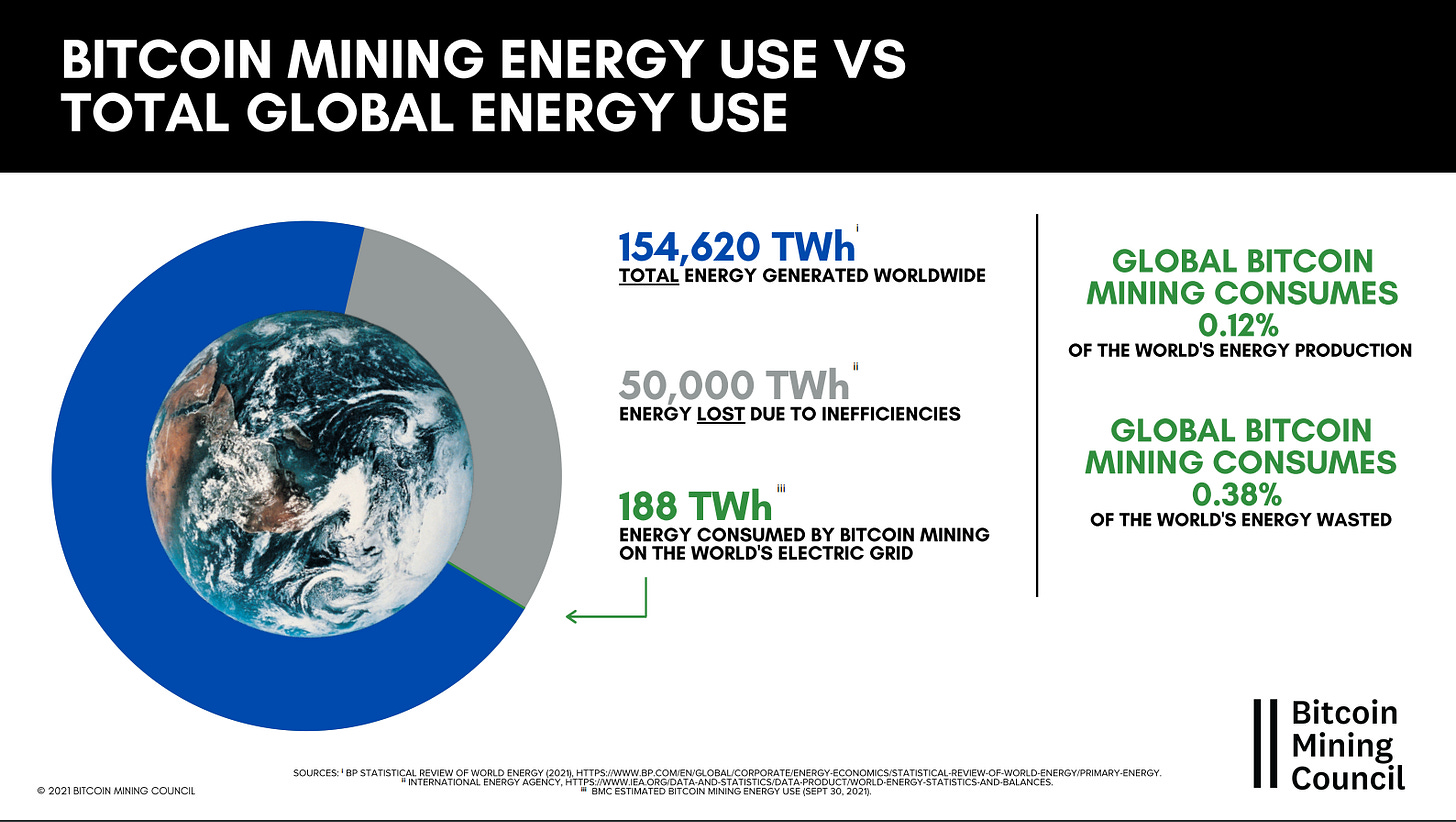

Bitcoin Mining Council, organization created by Michael Saylor in order to end this FUD, gathered some very explicit data to show Bitcoin mining impact:

However that’s not all. Thanks to its flexibility and mobility, crypto mining can not only capture 1/3 of the world’s electricity that is lost, it can even have a positive impact on the environment, notably by capturing flared gas.

The gas is a natural byproduct of oil production, but it cannot be easily stored or transported, so most often than not it is released (flared) right there on the oil drilling site, emitting into the atmosphere dangerous air pollutants like black carbon, methane, and volatile organic compounds. Crypto mining can be an ingenious solution to this problem: diverting the gas to the generators, which convert it into electricity, and then using it to mine coins is an excellent economic incentive profitable to both the miner and the environment ?

Companies like Crusoe Energy Systems specialize in helping oil firms to start with crypto mining, and this week it became known that they managed to score a particularly high-profile client. World’s top producer of oil and gas, ExxonMobil, has reportedly launched crypto mining pilot in its fields in North Dakota, and is considering expanding it to its sites in Alaska, Nigeria, Argentina, Guyana and Germany.

In 2015 the World Bank introduced the initiative “Zero routing flaring by 2030”. It can be that crypto mining will become the essential tool to achieving this.

It takes time and effort to dig into the details and the possibilities of crypto mining, but it is very easy to take the fake “eco-friendly” stance and try to earn the ecological votes. Two weeks ago, the ECON committee of the EU Parliament voted quite narrowly against the version of the MiCA law containing the proposal to ban PoW-based blockchains from the EU: 32 against, 24 in favour. This proposal was removed from the initial draft after crypto and mining specialists have explained the lawmakers how inappropriate it would be, but the pressure from the so-called “ecologists” was so strong that it was back on the table two days before the vote. We are happy that the reason prevailed, but the way this question was handled means that the “ecological” FUD still needs more efforts to be stopped.