This week’s story: Do monetary institutions have too much power?

Economic well-being of the world depends on the decisions of a handful of people seated on the boards of key Central Banks and institutions like the IMF.

This statement alone should raise concern, even under the assumption that these people believe they act in the best interest of people and in the most objective way.

Human nature, however, is alien to objectivity, and we all prefer our decisions to serve our goals. Moreover, we all are prone to mistakes and miscalculations. These all-too-human flaws, when taken to the high level of monetary power, can result in disastrous consequences that millions of people will bear for years after they are done.

We at D.Center think that giving that much power to monetary institutions wasn’t such a good idea, and that freeing money from institutional control would benefit us all. Here’s why.

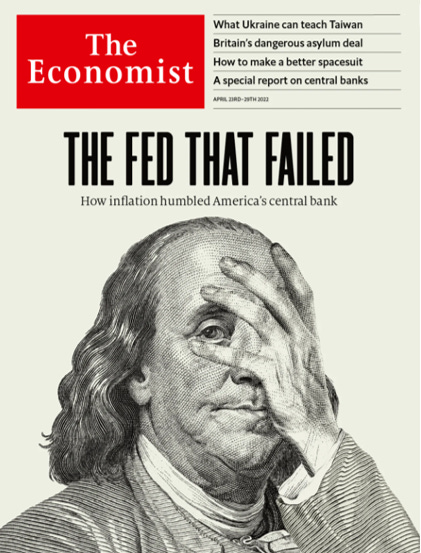

The Fed that failed

Stock markets are bleeding these weeks, dragging crypto along. One of the key reasons is the hawkish attitude of the Fed, which announced this week another 0.5% interest rate hike, with more to come. The Fed has also started reducing asset holdings on its balance sheet, discontinuing its purchases of T-bills and mortgage-backed securities.

Such actions are always disadvantageous for business and investing, which in the current geopolitical situation would rather need some support. Moreover, rates hiking poses a serious threat to the US government solvency: with the budget deficit that doesn’t cease to grow, the government will have to borrow even more money just to keep up with the interest payments for its gigantic national debt of over $30Tr.

The problem is, however, that the Fed cannot do otherwise. It has created too much money out of thin air (its balance sheet has been multiplied by 9 (!) since 2008), which has translated into an 8.5% (official) inflation spiralling out of control. The Fed has set a trap, into which the United States and the whole financial world are falling now.

How could this happen?

Every high school student knows that if you print more money, the value of this money will go down, and the prices – up. That’s inflation 101. How come the Ivy-League-graduated people in suits from the Fed did not know it? ?

Well, they did. But they are only people, and they too yield to political pressures and their own career objectives. So the dollars continued being printed, and excuses continued being created (Ivy-League-level excuses!): from the modern monetary theory that uses twisted logic and a lot of economic lingo to persuade people that governments can create money ad vitam, to blaming it all on the Covid-disrupted supply chains. The russian war against Ukraine could have given another set of excuses, but it may be too late now: while most people and mainstream media have been repeating the Fed’s babble for two years, they too start to get tired of it, and the recent issue of The Economist is sporting an unambiguous accusation on the cover: “The Fed That Failed”.

The Economist accuses the Fed of losing control over its main function – controlling the inflation – in its pursuit of political issues, notably societal and ecological. For an institution that is touted for being “separated” from the politics and free-money-seeking voters, that’s a failure, albeit a very understandable one. Elected politicians choose the Fed’s Chair from a small pool of high-flying officials, who made their way to the top by doing internal politics; and there’s no objectivity there.What does crypto have to do with this?

There is one category of people who have called the Fed’s bluff early on – the crypto enthusiasts. Being a practical and liberal folk, they could see past ceremonials and sophistries, and the Fed’s money printing machine has been pointed at in every form, from memes to economic essays. In contrast to Bitcoin of course: a currency that is forever capped at 21M does stand out in the land of free money. Bitcoin is a scarce money that cannot be manipulated, and this is why it represents a major alternative to the dollar.

It is a shame, of course, that Bitcoin is still following the stocks’ market movements, including the recent dip – it shows that most traders see it as an asset and not money. However, we believe that the paradigm would eventually change, and Bitcoin becomes decorrelated with the stocks for good.

The IMF that overstepped the mark

The International Monetary Fund is not a fan of Bitcoin’s.

It has tried to shame El Salvador out of adopting it as a legal tender using the AML pretext, but received a rather direct demand to not mess into a sovereign country’s affaires, accompanied by a set of sarcastic tweets from the Salvadoran President Nayib Bukele.

It succeeded in Argentina though. The country promised to stifle its crypto industry in exchange for a $45Bn loan. This week the Argentine Central Bank has officially prohibited financial institutions from offering crypto-related services.

The ban comes a day after Argentina’s biggest private bank Banco Galicia added the option to trade crypto on its platform, and a week after the Mayor of Buenos Aires announced the city’s crypto-friendly intentions.

Tough luck for this bank, for the city of Buenos Aires, for Argentina’s crypto businesses and especially its people, who try to deal with >50% inflation and strict currency controls.

While IMF was busy blackmailing Argentina, a small African nation of Central African Republic has made a crypto move, becoming the second country in the world to adopt Bitcoin as a legal tender.

One of the poorest countries on the world, but rich in diamonds, gold and uranium, C.A.R. could use Bitcoin to bank it mostly unbanked population. It could also use Bitcoin to easily connect to the worldwide markets, which was thus far controlled by France that is still keeping a huge economic influence over its former colonies’ economies via the CFA franc, a colonial money used by 14 African nations.

The IMF reacted by saying that “the adoption of Bitcoin as legal tender in C.A.R. raises major legal, transparency, and economic policy challenges.” ?

What is the IMF anyway?

IMF’s official mission is to “further international monetary cooperation, encourage the expansion of trade and economic growth and discourage policies that would harm prosperity”. It does not precise that all these must be achieved in the dollar-backed world though.

Based in Washington D.C., the IMF was founded to address the discrepancies in the dollar-gold exchange rate, but since President Nixon threw the gold standard away in 1971, it basically requalified into keeping a fiat dollar as a universal currency, making sure that the countries it directs financial help to will keep the dollar standard.

The IMF board represents 190 countries according to their relative positions in the world economy, which means that the US has got the biggest number of votes – 16.5%, and it contributes a comparable amount to the capital pool from which the loans are distributed. While the IMF’s total capacity for lending is about $1Tr, the Fed has created over $5Tr in just two years from 2020 to 2022. One can argue that pooling into the IMF is a small price to pay for trying to keep the whole world continuing using dollar as a reserve and international trade currency.

A borderless Bitcoin is clearly a threat to this plan, but the IMF can always hold its loans over the heads of poor countries to dissuade them from using it. In the meantime, the number of crypto-friendly views in some of the American states and even on the Capitol Hill is growing, and the US crypto industry is getting ever bigger.

Too bad for Argentina ?

The dollar standard has been here for 50 years, and most people are so used to it they don’t ever question what happens behind the scenes. These questions, however, are important to understand the current economic situation and the ways it can be improved. They can also help in understanding the importance of Bitcoin’s independence from any institution, politics or personal ego.

Let’s challenge the status quo ?